Renters Insurance in and around Akron

Akron renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Akron Renters!

There's a lot to think about when it comes to renting a home - parking options, location, furnishings, house or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Akron renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Safeguard Your Personal Assets

The unanticipated happens. Unfortunately, the valuables in your rented property, such as a video game system, a guitar and a smartphone, aren't immune to break-in or vandalism. Your good neighbor, agent Paul Bucar, has the knowledge needed to help you know your savings options and find the right insurance options to help keep your things protected.

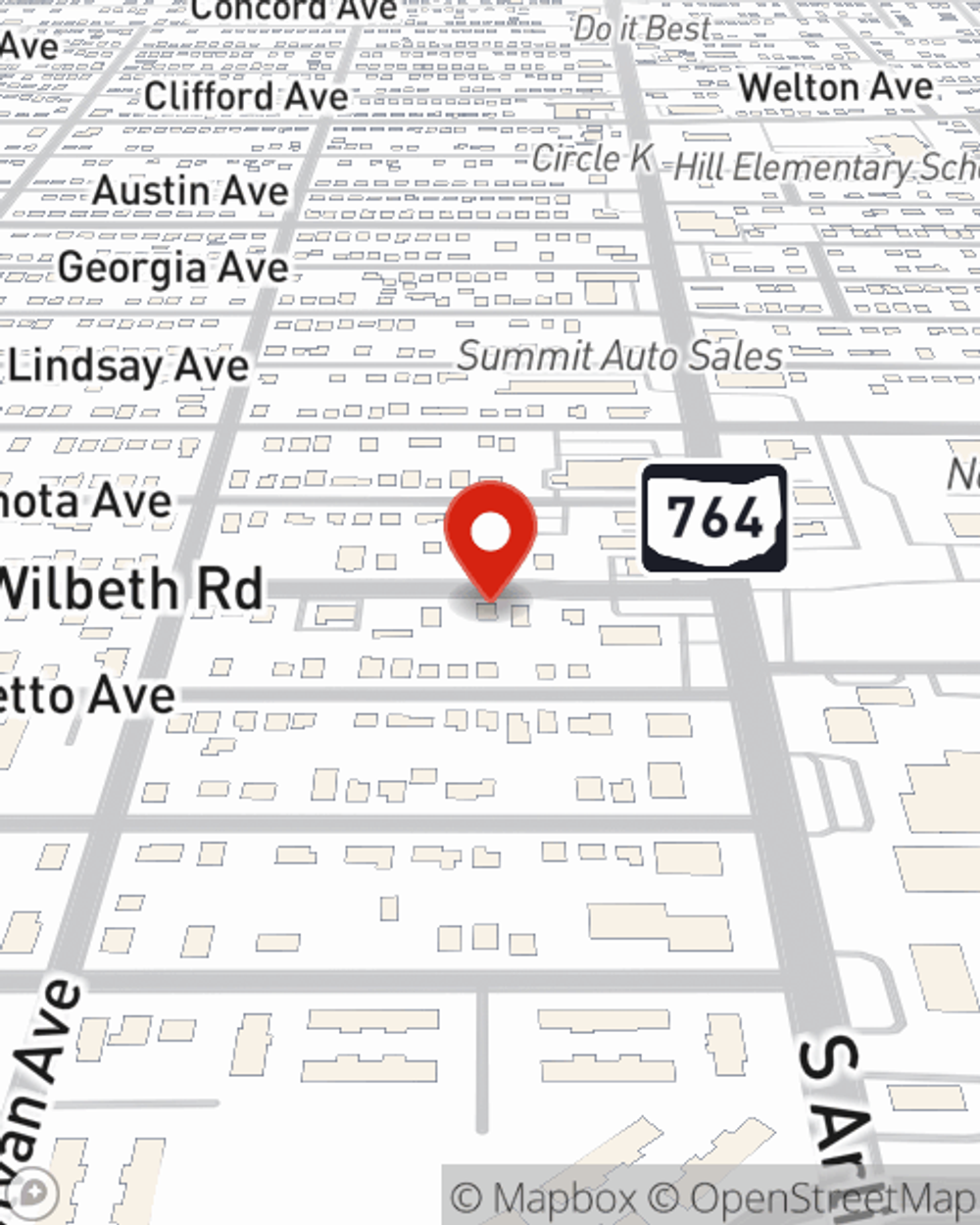

Renters of Akron, State Farm is here for all your insurance needs. Get in touch with agent Paul Bucar's office to learn more about choosing the right policy for your rented condo unit.

Have More Questions About Renters Insurance?

Call Paul at (330) 773-6814 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.